By Aran Ali Graphics/Design: Alejandra Dander

The Briefing

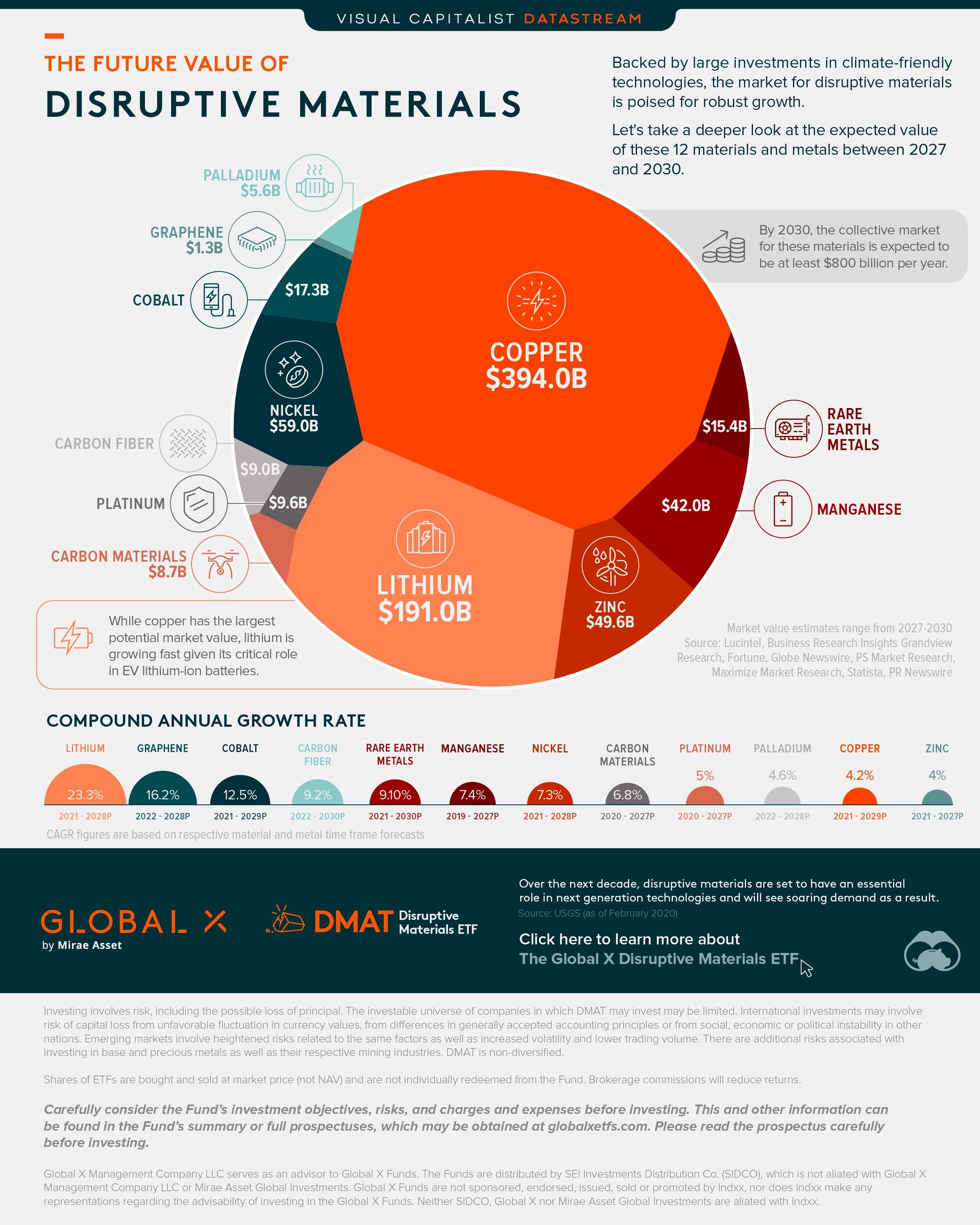

- By 2030, the collective market for disruptive materials is expected to reach over $800 billion

- Copper is the largest market while lithium is the fastest growing

The Future Value of Disruptive Materials

A select number of materials have a critical role to play in the expansion of next generation technologies. This could lead to a surge in demand and a potential soaring of market values for each material as a result.

This graphic from Global X ETFs takes a closer look at the forecasted market value for 12 disruptive materials, which are seeing increasingly large climate investment.

Soaring Market Values

The materials highlighted are each a billion dollar market in their own right. But which has the largest projected future market value?

Copper is one of the largest and most mature markets from this group. And as a result sees a lower projected compound annual growth rate (CAGR).

| Disruptive Material | Projected Market Value ($B) | CAGR (over forecast period) |

|---|---|---|

| Copper | $394.0B by 2029 | 4.2% (2021-2029P) |

| Lithium | $191.0B by 2028 | 23.3% (2021-2028P) |

| Nickel | $59.0B by 2028 | 7.3% (2021-2028P) |

| Zinc | $49.6B by 2027 | 4.0% (2021-2027P) |

| Manganese | $42.0B by 2027 | 7.4% (2019-2027P) |

| Cobalt | $17.3B by 2029 | 12.5% (2021-2029P) |

| Rare Earth Metals | $15.4B by 2030 | 9.1% (2021-2030P) |

| Platinum | $9.6B by 2027 | 5.0% (2020-2027P) |

| Carbon Fiber | $9.0B by 2030 | 9.2% (2022-2030P) |

| Carbon Materials | $8.7B by 2027 | 6.8% (2020-2027P) |

| Palladium | $5.6B by 2028 | 4.6% (2022-2028P) |

| Graphene | $1.3B by 2028 | 16.2% (2022-2028P) |

However, when it comes to the fastest growing market, lithium reigns supreme with a CAGR of over 23% between the forecast period of 2021 and 2028. Lithium is a vital ingredient for lithium-ion batteries, used in EVs and elsewhere.

Altogether, the collective market value for these top materials is expected to be worth over $800 billion by the end of the decade. And in the subsequent years, as efforts to tackle climate change accelerate, the collective value of these materials may well hit $1 trillion.

Introducing the Global X Disruptive Materials ETF

The Global X Disruptive Materials ETF (Ticker: DMAT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Disruptive Materials Index.

The Global X Disruptive Materials ETF is a passively managed solution that can be used to gain exposure to the rising demand for disruptive materials. Click the link to learn more.

Copyright © 2023 Visual Capitalist