By Govind Bhutada Graphics/Design: Miranda Smith

Visualizing Global Gold Production Over 200 Years

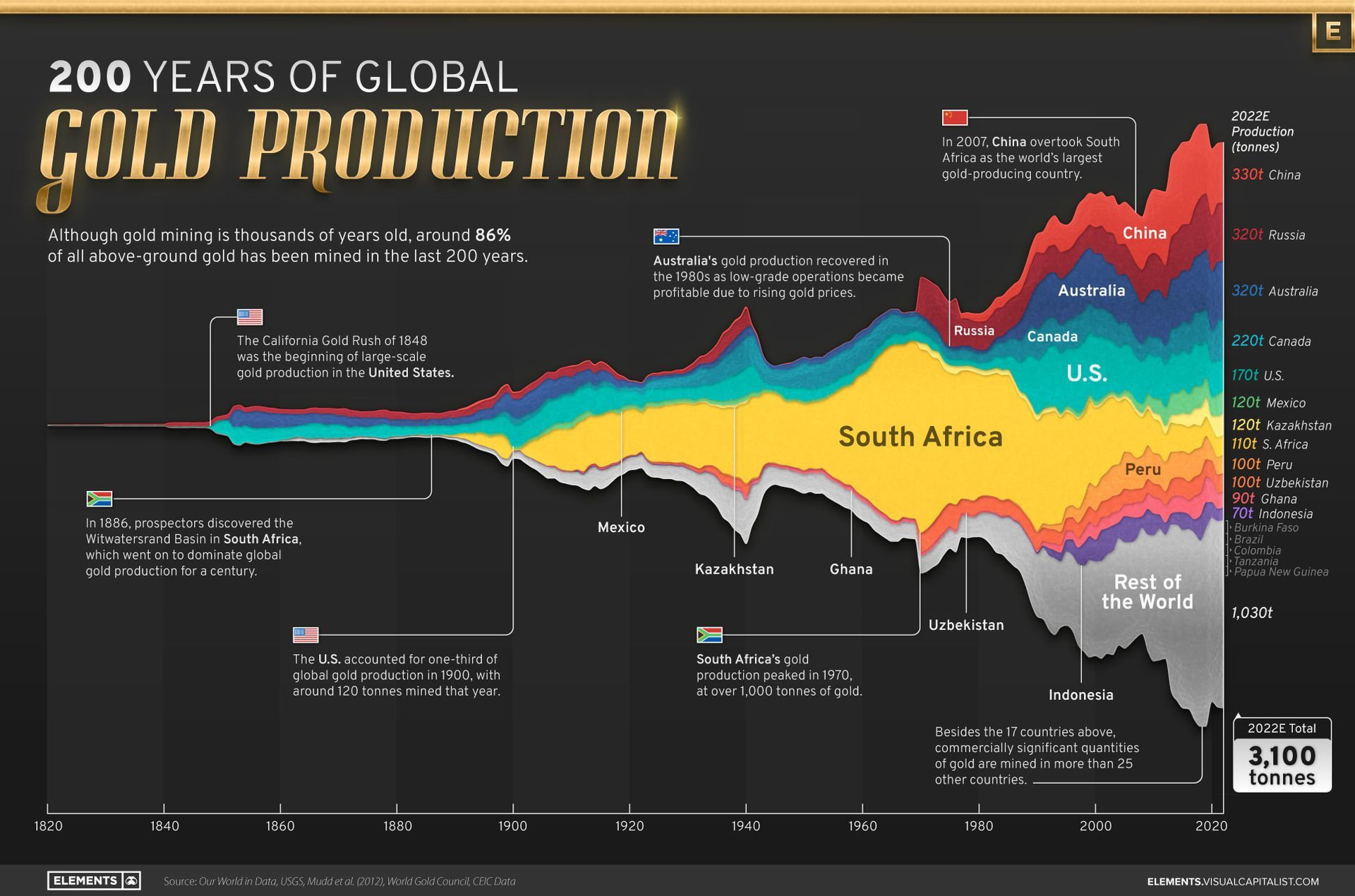

Although the practice of gold mining has been around for thousands of years, it’s estimated that roughly 86% of all above-ground gold was extracted in the last 200 years.

With modern mining techniques making large-scale production possible, global gold production has grown exponentially since the 1800s.

The above infographic uses data from Our World in Data to visualize global gold production by country from 1820 to 2022, showing how gold mining has evolved to become increasingly global over time.

A Brief History of Gold Mining

The best-known gold rush in modern history occurred in California in 1848, when James Marshall discovered gold in Sacramento Valley. As word spread, thousands of migrants flocked to California in search of gold, and by 1855, miners had extracted around $2 billion worth of gold.

The United States, Australia, and Russia were (interchangeably) the three largest gold producers until the 1890s. Then, South Africa took the helm thanks to the massive discovery in the Witwatersrand Basin, now regarded today as one of the world’s greatest ever goldfields.

South Africa’s annual gold production peaked in 1970 at 1,002 tonnes—by far the largest amount of gold produced by any country in a year.

With the price of gold rising since the 1980s, global gold production has become increasingly widespread. By 2007, China was the world’s largest gold-producing nation, and today a significant quantity of gold is being mined in over 40 countries.

The Top Gold-Producing Countries in 2022

Around 31% of the world’s gold production in 2022 came from three countries—China, Russia, and Australia, with each producing over 300 tonnes of the precious metal.

| Rank | Country | 2022E Gold Production, tonnes | % of Total |

|---|---|---|---|

| #1 | 🇨🇳 China | 330 | 11% |

| #2 | 🇷🇺 Russia | 320 | 10% |

| #3 | 🇦🇺 Australia | 320 | 10% |

| #4 | 🇨🇦 Canada | 220 | 7% |

| #5 | 🇺🇸 United States | 170 | 5% |

| #6 | 🇲🇽 Mexico | 120 | 4% |

| #7 | 🇰🇿 Kazakhstan | 120 | 4% |

| #8 | 🇿🇦 South Africa | 110 | 4% |

| #9 | 🇵🇪 Peru | 100 | 3% |

| #10 | 🇺🇿 Uzbekistan | 100 | 3% |

| #11 | 🇬🇭 Ghana | 90 | 3% |

| #12 | 🇮🇩 Indonesia | 70 | 2% |

| - | 🌍 Rest of the World | 1,030 | 33% |

| - | World Total | 3,100 | 100% |

North American countries Canada, the U.S., and Mexico round out the top six gold producers, collectively making up 16% of the global total. The state of Nevada alone accounted for 72% of U.S. production, hosting the world’s largest gold mining complex (including six mines) owned by Nevada Gold Mines.

Meanwhile, South Africa produced 110 tonnes of gold in 2022, down by 74% relative to its output of 430 tonnes in 2000. This long-term decline is the result of mine closures, maturing assets, and industrial conflict, according to the World Gold Council.

Interestingly, two smaller gold producers on the list, Uzbekistan and Indonesia, host the second and third-largest gold mining operations in the world, respectively.

The Outlook for Global Gold Production

As of April 25, gold prices were hovering around the $2,000 per ounce mark and nearing all-time highs. For mining companies, higher gold prices can mean more profits per ounce if costs remain unaffected.

According to the World Gold Council, mined gold production is expected to increase in 2023 and could surpass the record set in 2018 (3,300 tonnes), led by the expansion of existing projects in North America. The chances of record mine output could be higher if gold prices continue to increase.

Copyright © 2023 Visual Capitalist