Silver vs. Stocks: Comparing Performance During Recessions

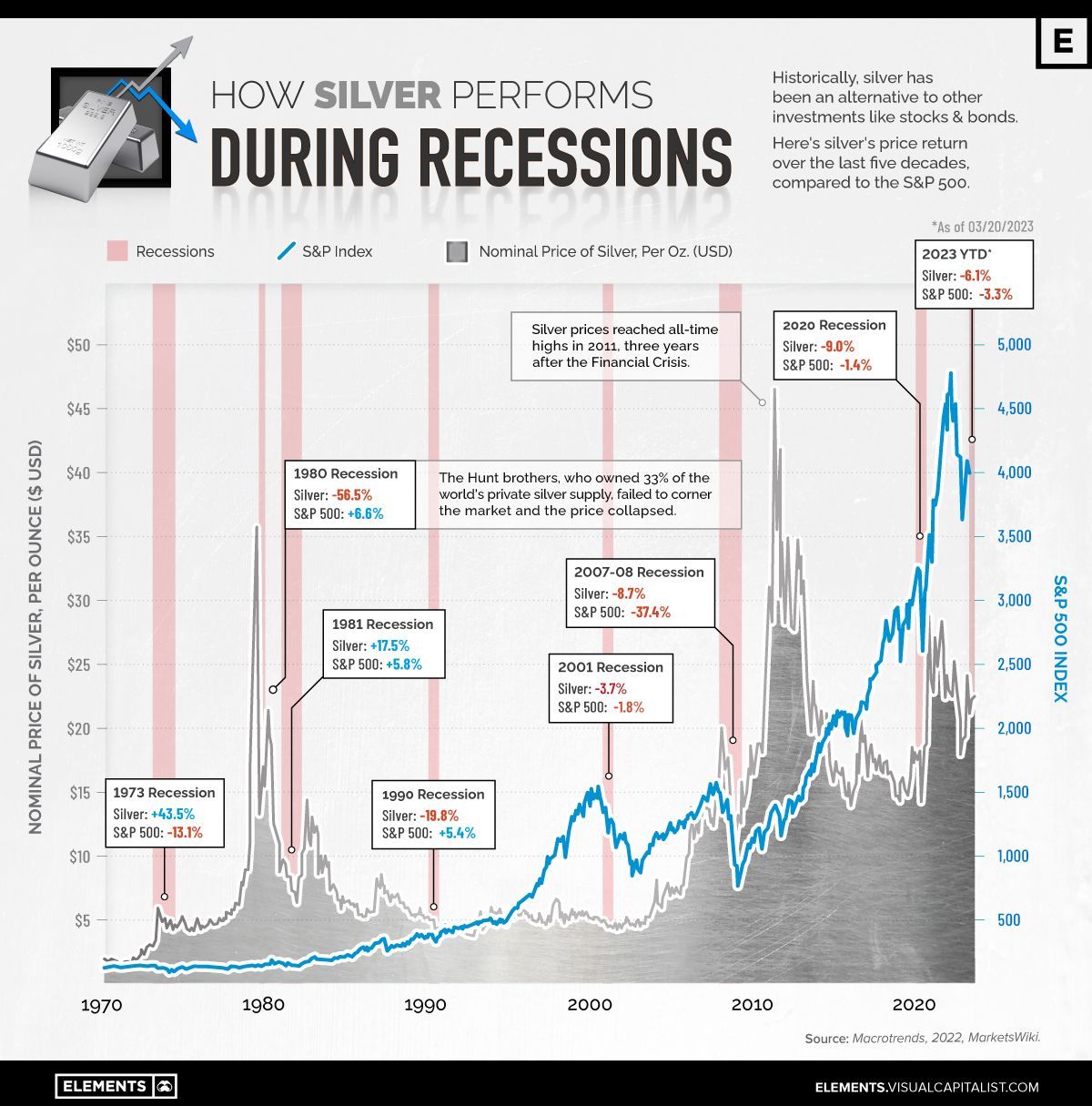

Historically, silver has been an alternative to traditional investments like stocks and bonds.

Amid the recent wave of bank failures and rising interest rates, many investors sought the metal, making prices jump.

But has silver helped investors weather recessionary storms in the past? The above graphic uses data from Macrotrends to highlight silver’s price movements during recessions and compares it to changes in the S&P 500.

Silver Price During Recessions

Like gold, silver’s value comes from its scarcity as a precious metal. Silver, however, has a higher industrial use, from electronics and medical applications to batteries and solar panels.

Additionally, the silver market is much smaller than the gold market, making it a much more volatile asset.

The metal saw its biggest price drop in 1980 when it tumbled over 56% after the Hunt brothers, who controlled over half of the world’s privately owned silver, failed in an attempt to corner the market and were forced to sell after a rise in margin requirements.

Silver prices plummeted again during the 1990s recession before a steady recovery that culminated in an all-time high reached in 2011, three years after the 2007-2008 Financial Crisis.

Over the last five decades, silver has only outperformed the S&P 500 in three of eight recessions: 1973, 1981 and 2007.

| Recession Year | Recession length | % change in nominal price of silver | % change in S&P 500 |

|---|---|---|---|

| 1973 | 16 months | 43.5% | -13.1% |

| 1980 | 6 months | -56.5% | 6.6% |

| 1981 | 16 months | 17.5% | 5.8% |

| 1990 | 8 months | -19.8% | 5.4% |

| 2001 | 8 months | -3.7% | -1.8% |

| 2007 | 18 months | -8.7% | -37.4% |

| 2020 | 2 months | -9% | -1.4% |

As of March 2023, the silver nominal price was down 6.1% while the S&P500 was down 3.3%.

Silver Price in 2023

Over the next months, silver demand is expected to rise, supporting the price. Silver’s industrial market could be lifted from further gains in vehicle electrification and governments’ expanding commitment to green infrastructure, according to the Silver Institute.

However, if the economic scenario worsens and industrial users of silver reduce their output, the metal may face some headwinds.

Copyright © 2024 Visual Capitalist