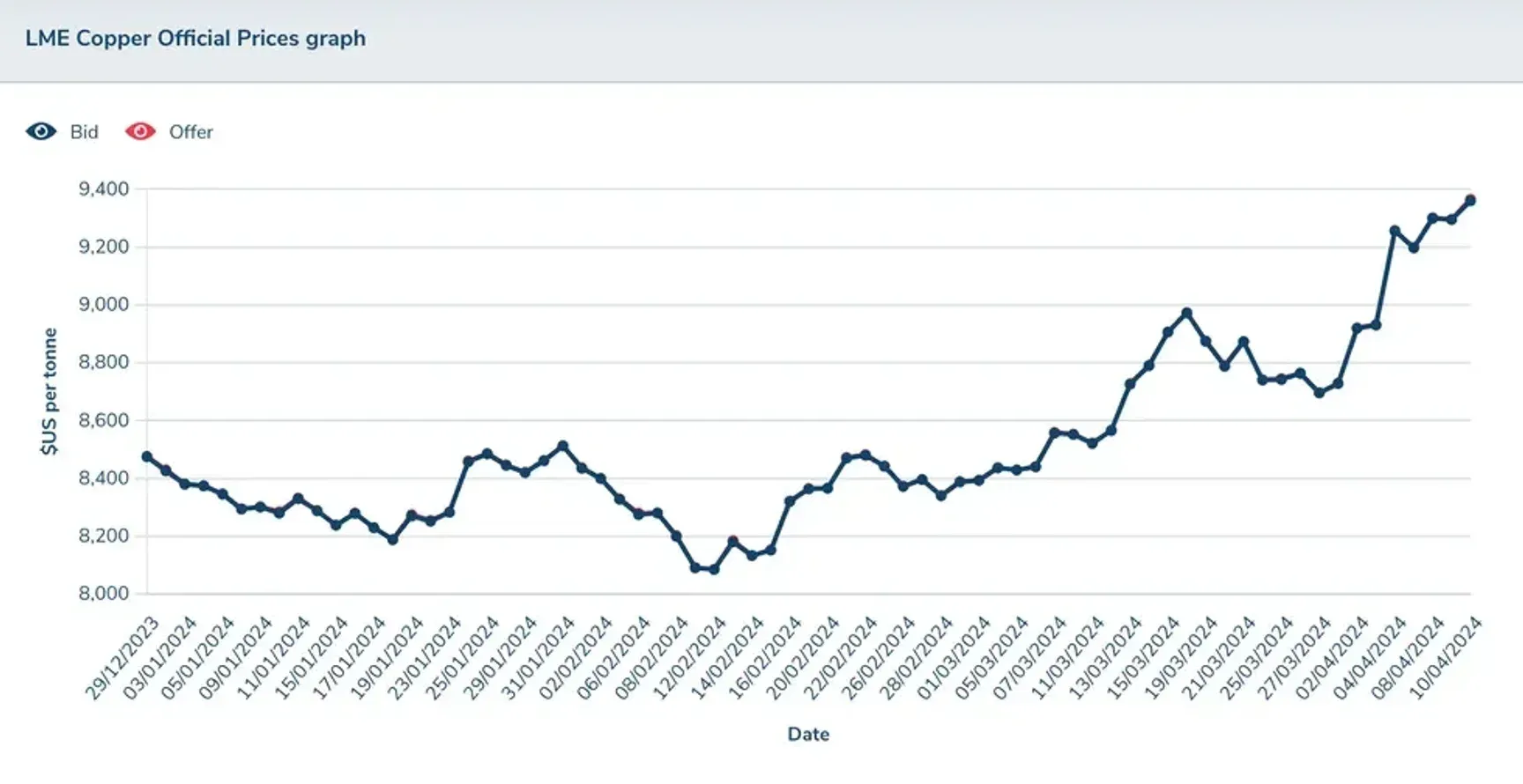

The red metal reached an intraday high of US$9,365 per metric ton on April 10 for first time since June 2022.

Copper prices hit a nearly two year high this week, and according to analystsat investment bank Citigroup (NYSE:C) that's a sign the red metal has entered its second secular bull market of the century.

Over the past two months, copper has surged by more than 15.75 percent, fueled by disruptions at mining operations that have threatened refined copper production in China, a major global supplier.

“The recent disruptions to major mines are starting to ripple through the industry,” said strategist Daniel Hynes of Melbourne's ANZ Bank. “A group of 13 major copper smelters in China is preparing for a possible 10 percent production cut due to a collapse in treatment and refining charges.”

In an article published on Thursday (April 11), Warren Patterson and Ewa Manthey of research firm ING said they believe copper's price move can be attributed to a global supply deficit.

“The main catalyst for copper’s rally is the unexpected tightening in the global mine supply, most notably First Quantum’s (TSX:FM,OTC Pink:FQVLF) mine in Panama, which has removed around 4,000,000 tonnes of the metal from the world’s annual supply," they wrote. The Cobre Panama mine was forced to shut its doors at the end of 2023.

Copper's 2024 price performance.

Chart via the London Metal Exchange.

“In addition, Anglo American (LSE:AAL,OTCQX:AAUKF), said it was cutting output by 200,000 tonnes. And Codelco, the world’s biggest copper producer, is struggling to recover from the lowest output in a quarter of a century,” they added.

Analysts at Bank of America (NYSE:BAC) also believe copper supply is at risk, citing a lack of new mines. The firm recently raised its 2024 price target to US$9,321 per metric ton (MT), up from its previous forecast of US$8,625.

On the demand side, China's economic recovery is adding fuel to the fire. Positive signs like a strong Purchasing Managers' Index and rising exports are raising hopes for a renewed surge in Chinese copper demand.

During the 2000s bull market, copper prices leaped more than fivefold in three years on the back of rapid urbanization and industrialization in the Asian nation. Analysts suggest a similar trend could unfold over the next three years.

Other base metals, including zinc, have also experienced gains amid concerns over Chinese refined output risks.

Exploration challenges threaten future copper supply

Copper supply woes are not a new issue — decades-old problems are behind the growing shortfall.

Declining exploration spending has disproportionately impacted junior mining companies. These companies, which are vital for early stage discovery, witnessed an 8 percent drop in exploration expenditures in 2023.

Junior explorers play a key role in finding new copper deposits, but lack of investment makes it difficult for them to secure funding for the high-risk, high-reward projects needed to identify the next generation of copper mines.

While overall copper exploration funding saw a 12 percent increase last year, the majority of these investments — around US$3.12 billion — went toward existing or near-production assets instead of discovery.

Copper’s positive price fundamentals have prompted analysts to anticipate further increases in the coming months.

As of 9:57 a.m. EDT on Thursday (April 11) copper was trading at US$9,374 on the London Metal Exchange.