By Sponsored Content Article/Editing: Alan Kennedy Graphics/Design: Alejandra Dander

Visualized: A Decade of Clean Energy Investment

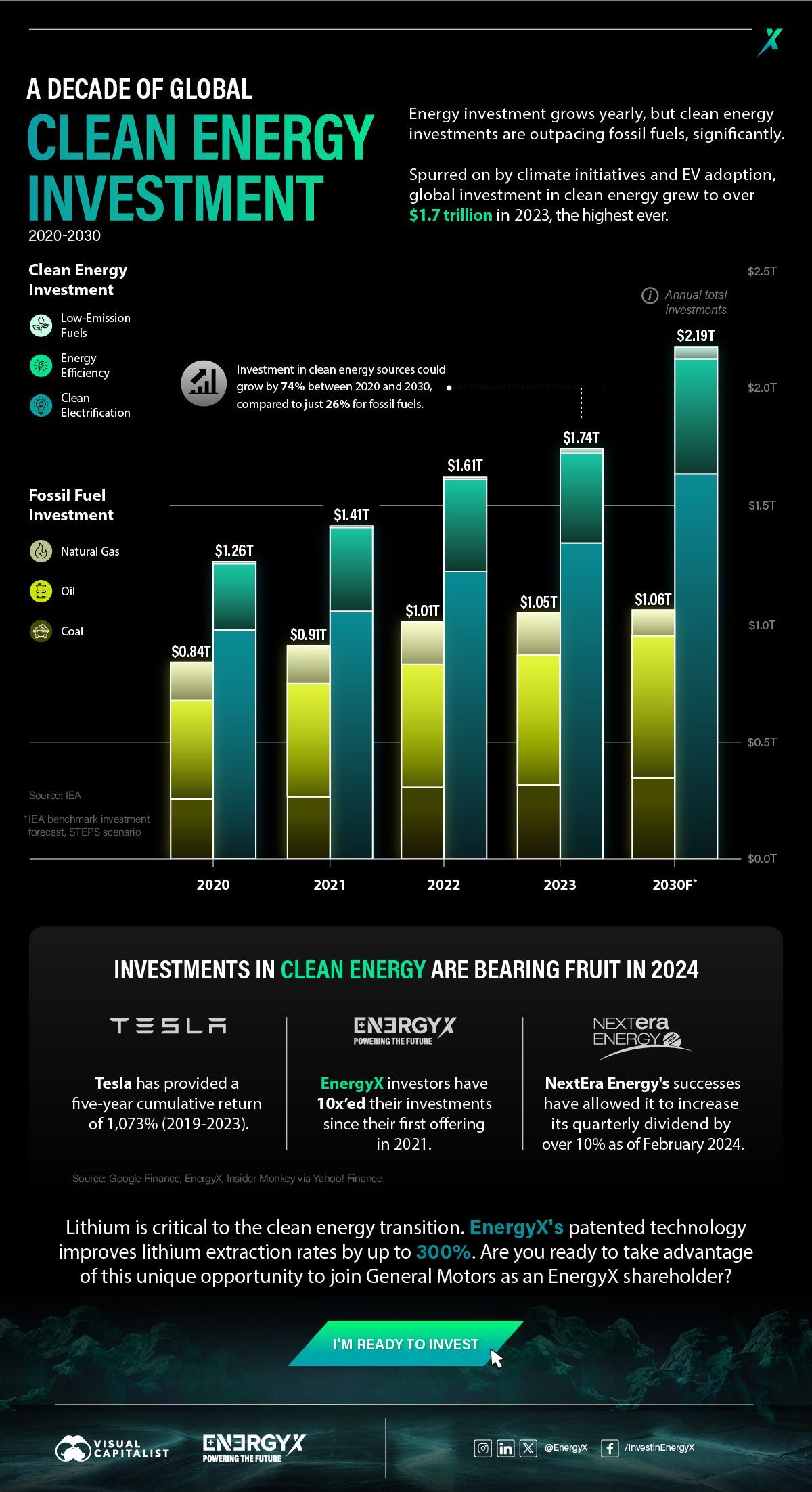

Global energy investment is growing every year. But recently, investments in clean energy have been significantly outpacing investments in fossil fuels.

For this graphic, we partnered with EnergyX to explore how global energy investment has changed and learn how investments in clean energy are starting to pay off for their investors.

The Rise of Sustainable Energy Investment

Propelled by various climate initiatives such as the Paris Agreement and the widespread adoption of EVs, global investment in sustainable energy surged to over $1.7 trillion in 2023, the highest ever, and the IEA projects that this growth could continue:

| Energy Product | 2020 | 2021 | 2022 | 2023 | 2030F |

|---|---|---|---|---|---|

| Clean Electrification | $0.97T | $1.05 | $1.21T | $1.34T | $1.65T |

| Low-Emission Fuels | $0.01T | $0.01 | $0.01T | $0.02T | $0.05T |

| Energy Efficiency | $0.28T | $0.35 | $0.39T | $0.38T | $0.49T |

| Clean Energy Total | $1.26T | $1.41T | $1.61T | $1.74T | $2.19T |

| Natural Gas | $0.26T | $0.27T | $0.31T | $0.32T | $0.35T |

| Oil | $0.42T | $0.48T | $0.52T | $0.55T | $0.60T |

| Coal | $0.16T | $0.16T | $0.18T | $0.18T | $0.11T |

| Fossil Fuel Total | $0.84T | $0.91T | $1.01T | $1.05T | $1.06T |

| Total Energy Investment | $2.10T | $2.32T | $2.62T | $2.79T | $3.25T |

Between 2020 and 2030, global investment in sustainable energy could increase by 74% to nearly $2.2 trillion, compared to just 26% additional investment in fossil fuels, with a forecast total of $1.06 trillion. This shows that sustainability is the future of energy investment.

Sustainable Investor Success Stories

While the growing investments in clean energy show that the world embraces sustainability, energy investors will still look for decent returns. Now, in 2024, clean energy investments are beginning to bear fruit. Here are just a few examples:

- Between 2019 and 2023, Tesla had a cumulative return of 1,073%

- NextEra Energy’s quarterly dividend increased by over 10% as of February 2024

- Investors in EnergyX have 10x’ed their investments since the company’s first offering in 2021

Lithium plays a critical role in powering electric vehicles (EVs) and facilitating the transition to sustainable energy. EnergyX has patented technology that enhances lithium extraction rates by up to 300%, contributing to meeting the growing demand for lithium and fueling the EVs of the future.

Copyright © 2024 Visual Capitalist