Warning comes as falling prices hit commodity vital for green transition

Harry Dempsey and Euan Healy in London OCTOBER 9 2023

The world’s largest copper producers have warned that there is a lack of mines under development to deliver enough of the metal to keep pace with the clean energy transition.

The warning comes as miners struggle with falling metal prices because of the weakness of the global economy and cost inflation, which makes executives, investors and banks cautious over financing new projects.

With labour shortages also holding back new supplies, there are worries over the switch to carbon-free power since copper is vital to manufacture electric cars and upgrade the electricity grid.

Kathleen Quirk, president of Freeport-McMoran, the largest US copper producer, said that higher copper prices alone would not be enough to secure enough metal needed for the world to go green.

“Now it’s not just price. It’s these other factors that really are going to limit how quickly we can develop supplies,” she said, speaking on the sidelines of the FT Mining Summit last week. “What may end up happening is that this [energy transition] gets extended out longer.”

Copper prices have dropped 4 per cent this year to about $8,000 a tonne, down from more than $10,000 at their peak last year, as the growth in the world economy has cooled off and production at new mines in Peru and Chile has been increasing.

Yet demand for the commodity is expected to take off to supply the green economy, as well as to support the economic rise of India and other developing nations.

The living standards of the average westerner requires 200-250 kilogrammes of copper per person, versus 60kg on average globally, according to Anglo American, one of the world’s largest miners.

It is used in everything from electrical wiring and household appliances to infrastructure such as trains.

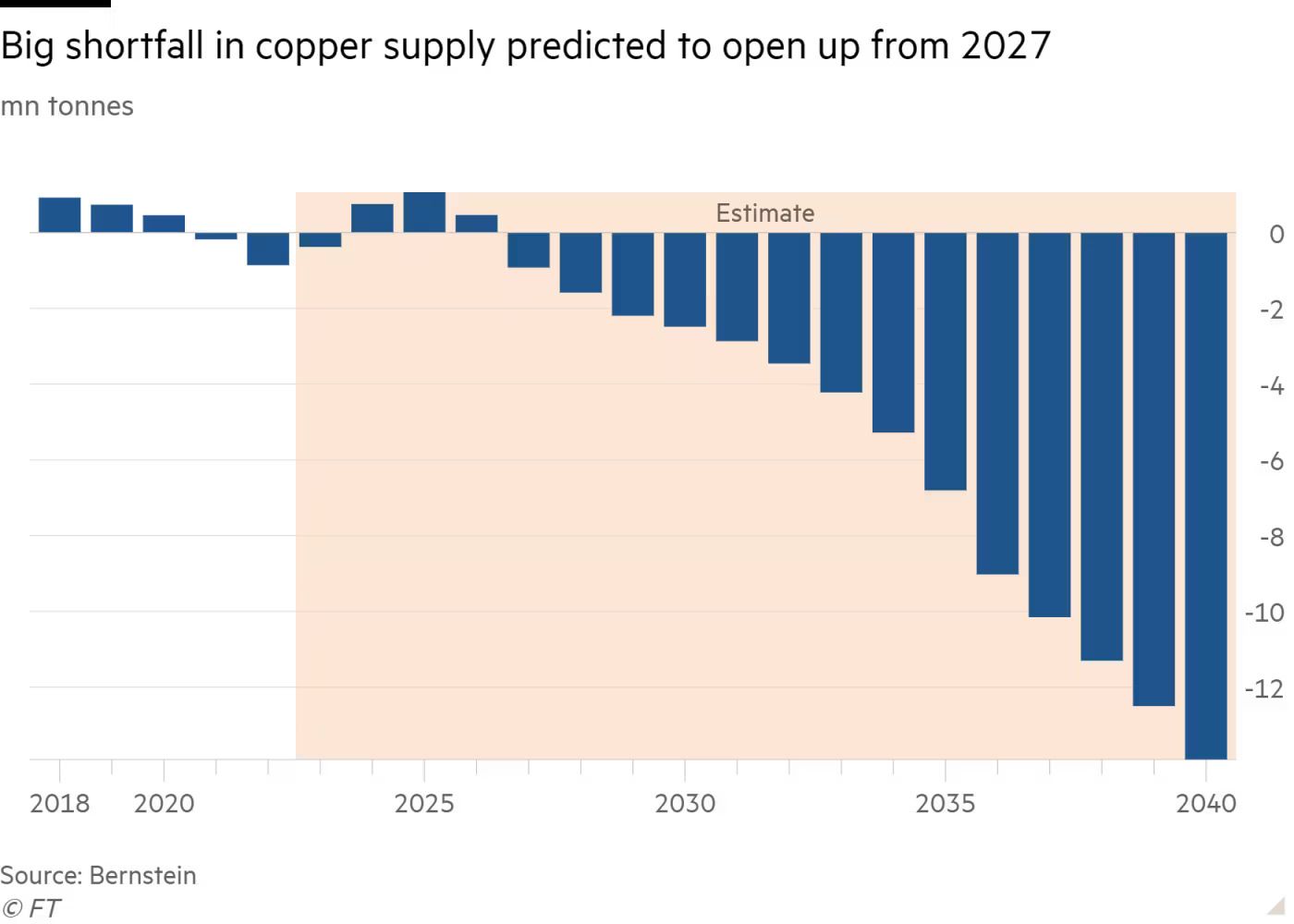

Its use will become ever greater as the world goes green, resulting in it being dubbed the “metal of electrification”, with forecasts that it will double to a 50mn tonne market by 2035 compared with 2021 levels, according to S&P Global, which predicts a “chronic gap” between supply and demand.

Also speaking at the FT summit, Robert Friedland, billionaire mining magnate and founder of Ivanhoe Mines, said that the current bout of softer prices would stoke shortages later on.

Despite huge expected growth, copper producers are struggling to generate enough large projects because the commodity is becoming harder to find in high quantities in the ground.

For example, Freeport is turning to new technology to extract copper from old piles of mining waste ahead of expanding mines.

Farid Dadashev, head of European metals and mining at RBC Capital Markets, said that executives were proving reluctant to invest in mines that will take 10-15 years to build and cost billions of dollars with low prices and political uncertainty in mining jurisdictions.

“When you add further complexity from longer permitting timelines, higher inflation and generally declining ore body grades, this perhaps explains why we’re finding ourselves in the situation where it’s likely there won’t be enough copper to meet decarbonisation goals in the next few decades,” he said.

Copper miners are becoming increasingly resigned to the likelihood of shortages later this decade driving innovation to substitute and reduce use of the metal in products, although it is uncertain how far this can go.

“There will be some restructuring of demand,” said Maximo Pacheco, chair of Codelco, the Chilean state mining group, which produced the lowest volume of copper in 25 years in 2022.

For some, the supply crunch for metals risks a trade-off between satisfying the decarbonisation goals of the economy and efforts to lift large parts of the world out of poverty without policy intervention.

“Something has to give somewhere along the line,” said Duncan Wanblad, chief executive of Anglo American.

© THE FINANCIAL TIMES LTD 2023